top of page

Search

Got Leftover 529 Money? Here’s What You Can Do With It

Got leftover 529 college savings money? Don’t let it go to waste! If your child finished school or didn’t use the full account, there are smart ways to put those funds to work. From paying down student loans to rolling over into a Roth IRA, changing the beneficiary, or carefully withdrawing as a last resort, leftover 529 funds can still benefit your family. Learn practical strategies to maximize your 529 plan and make every dollar count.

The Real Money Pros

Aug 19

Which Self-Employed Retirement Savings Plan Should I Choose?

If you're self-employed or own a small business, choosing the right retirement plan is key to securing your financial future. Options like SEP IRA, Solo 401(k), SIMPLE IRA, and Traditional or Roth IRAs each have unique benefits, contribution limits, and tax advantages. Whether you want to maximize savings, hire employees, or prefer Roth options, understanding these plans helps you make informed decisions and build long-term wealth.

The Real Money Pros

Aug 13

The Boring (and Time-Tested) Way to Become a Millionaire

Most millionaires didn’t get there by chasing crypto or timing the market—they followed a consistent, boring plan. Learn how automation, dollar-cost averaging, and long-term investing can quietly build real wealth, no matter when you start.

The Real Money Pros

Jun 27

The Forgotten Risk That Could Derail Your Retirement: Sequence of Returns

Worried about retirement risks? There’s one hidden danger that could derail your nest egg—Sequence of Return Risk. Discover how the timing of market ups and downs affects your withdrawals, and learn how to protect your future using the proven Bucket Strategy. This guide breaks down real-world examples, including the 2008 crash, and offers practical solutions for securing a sustainable retirement—no matter what the market does.

The Real Money Pros

Jun 4

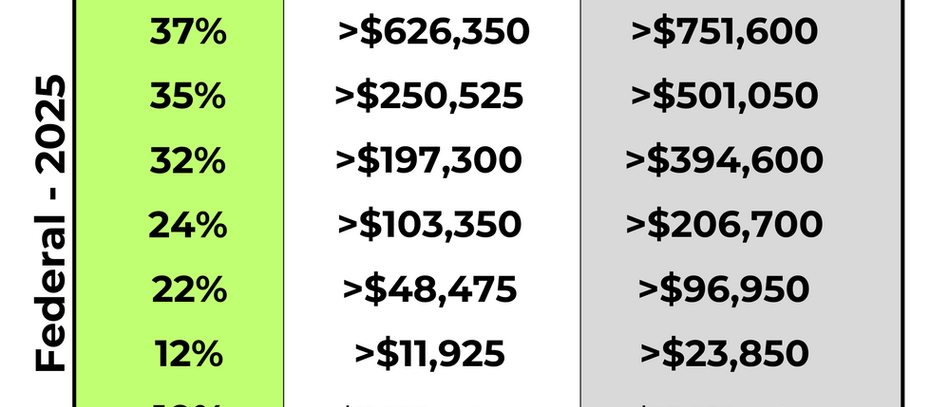

Taxation in Retirement: What You Need to Know (2025)

Explore key tax changes for retirees in 2025, including Social Security, RMDs, and state-level reforms to maximize your savings.

The Real Money Pros

Mar 27

Withdrawing Money In Retirement: Rethinking the 4% Rule

Rethink retirement withdrawals! Explore the 4% rule, tax strategies, and the bucket approach for lasting, stress-free savings.

The Real Money Pros

Jan 30

Planning for the Year Ahead - The Basics

And like that, 2024 is over… Here’s a breakdown of some key tips and updates to ensure you’re ready to tackle the new year with confidence.

The Real Money Pros

Dec 27, 2024

Business Owners Need to File Their Beneficial Ownership Information (BOI) Report NOW.

One critical requirement that many business owners may have overlooked in 2024 is filing the Beneficial Ownership Information (BOI) report.

The Real Money Pros

Nov 29, 2024

bottom of page